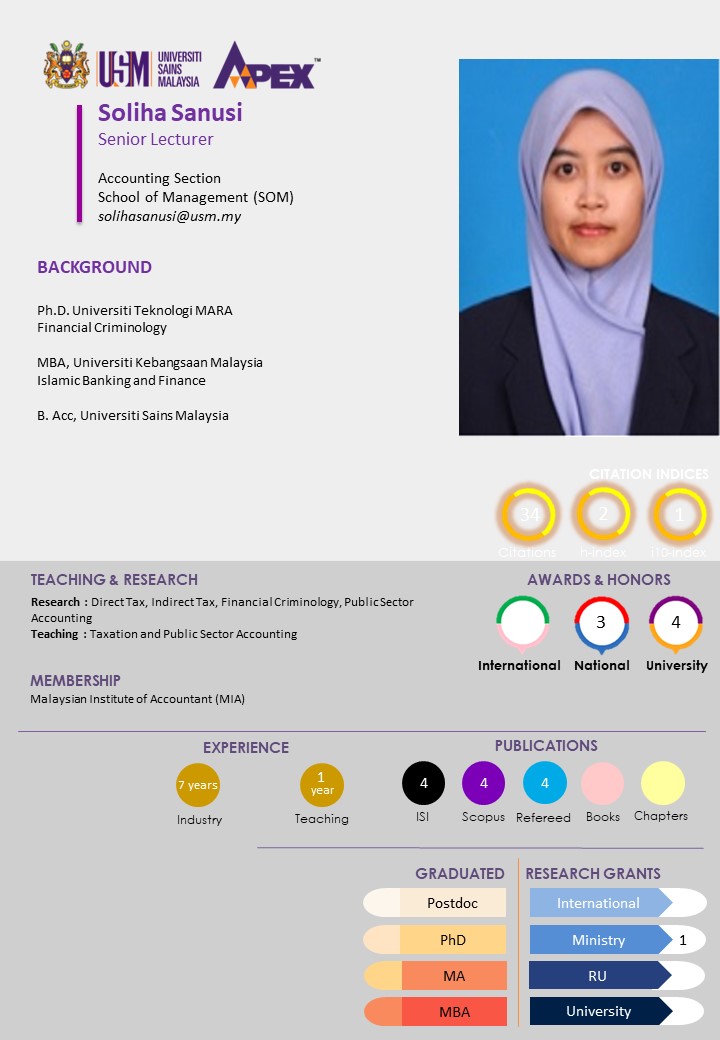

Dr. Soliha Sanusi

{tab=Profile}

{tab=Profile-Details}

Position: Senior Lecturer

Academic Qualifications:

PhD (UiTM, Malaysia)

MBA (UKM, Malaysia),

BAcc (USM, Malaysia)

Contacts:

Room: Indah Kembara L10-08

Phone: (+604) 653 5288

Fax: (+604) 657 7448

Email: solihasanusi@usm.my

Biodata:

Soliha Sanusi ia a Senior Lecturer at the School of Management of UniversitiSains Malaysia (USM). She is a Chartered Accountant (CA) of Malaysian Institute of Accountants (MIA). She obtained her Phd from the Universiti Teknologi MARA Malaysia in 2019. She was SLAB/SLAI recipient for her MBA and PhD studies. Her research interests are in the areas of direct tax, indirect tax, financial criminology, small medium enterprises, mixed method and public sector accounting. She has published and presented her research work in various conferences and journals. She also a reviewer for Management & Accounting Review, Asian Academy of Management Journal of Accounting & Finance and FGIC 2nd Conference on Governance and Integrity.

{tab=Research}

Research Area:

Direct tax, Indirect tax, Financial Criminology, Small Medium Enterprises, Mixed method study and Public Sector Accounting

Research Project:

The perception of taxpayers towards the duty of Inland Revenue Board Malaysia

On-going Research:

Completed Research:

{tab=Publication}

Selected Publications in Journals:

Sanusi, S., Omar, N., M.Sanusi, Z. & Noor, R., (2018). Goods and Services Tax compliance initiatives: Examining corporate taxpayers’ and regulator’s responsibilities in Malaysia. Contemporary Social Sciences, 27(3), 182–193.

Sanusi, S., A, Firdaus., Noor, R., Omar, N., & M.Sanusi, Z. (2018) Technology on Goods and Services Tax compliance among small medium enterprises in developing countries. Advanced Science Letters, 24, 5461-5465.

Sanusi, S., Omar, N., M.Sanusi, Z. & Noor, R., (2017). Moderating effect of audit probability on the relationship between tax knowledge and Goods and Services Tax (GST) compliance in Malaysia. Social Sciences & Humanities, 25, 231–240. (Scopus, Q2)

Zainan, N., Omar, N., Aziz, R. Noor, R., & Sanusi, S. (2017). Retailers’ behavioural factors towards Goods and Services Tax GST) compliance: Sociological and psychological approach study. Malaysian Accounting Review, 16(2), 116–128. (ERA)

Sanusi, S., Noor, R., Omar, N., & Sanusi, Z. M. (2017). The readiness of small and medium enterprises (SME) in Malaysia for implementing Goods and Services Tax (GST). Social Sciences & Humanities, 25, 241–250. (Scopus, Q2)

Sanusi, S., Md Noor, R., Omar, N., Mohd Sanusi, Z., & Alias, A. (2016). Goods and Services Tax (GST) readiness among petrol station operators in Malaysia. Information, 19(August), 3131–3136. (Scopus, Q2)

Sanusi, S., Omar, N., & M.Sanusi, Z. (2015). Goods and Services Tax (GST) governance in the Malaysian new tax environment. Procedia Economics and Finance, 31(December), 373–379.

Sanusi, S., & Shafiai, M. H. M. (2015). The management of cash waqf: toward socio-economic development of Muslims in Malaysia. Jurnal Pengurusan (UKM Journal of Management), 43. (Scopus, Q4)

Conference

Sanusi, S., Omar, N., Sanusi, Z. M. & Noor, R. 2017 ‘Goods and Services Tax compliance initiatives: Examining corporate taxpayers’ and regulator’s responsibilities in Malaysia’ paper presented at The International Symposium on Business and Social Sciences, Seoul, South Korea, 7-9 December 2017.

Sanusi, S., Omar, N., Sanusi, Z. M. & Noor, R. 2017. ‘Moderating effect of audit probability towards the relationship of tax knowledge with GST compliance in Malaysia’ paper presented at the Global Conference of Social Science Series, Bangsar, Malaysia, 4-5 May, 2017.

Sanusi, S., Omar, N. 2016. ‘Voluntarism and business sustainability in Goods and Services Tax compliance’ paper presented at the 4th Gadjah Mada International Conference on Economics and Business 2016, Jogjakarta Indonesia, 25-27 November 2016.

Sanusi, S., Noor, R., Omar, N., & Sanusi, Z. M. 2016. ‘The effect of competency and governance practices on Goods and Services Tax (GST) readiness among small medium enterprises (SME) in Malaysia’ paper presented at the 3rd International Conference on Science and Social Research, Putrajaya, Malaysia, 6-7 December 2016.

Sanusi, S., Md Noor, R., Omar, N., Mohd Sanusi, Z., & Alias, A. 2016. ‘Goods and Services Tax (GST) readiness among petrol station operators in Malaysia’ paper presented at the 2016 International Conference on Information in Business and Technology Management, Malacca Malaysia, 26-28 January 2016.

Sanusi, S. 2015, ‘Goods and Services Tax (GST) non-compliance among corporate taxpayers in the Malaysian new tax regime’ paper presented at the Asia Pacific Management Accounting Association 2015 Annual Conference, Bali Indonesia, 26-29 October, 2015.

Sanusi, S., Omar, N., & M.Sanusi, Z. 2015. ‘Goods and Services Tax (GST) governance in the Malaysian new tax environment’ paper presented at the The IV International Accounting and Business Conference, Putrajaya Malaysia, 17-18 August, 2015.

Sanusi, S., & Shafiai, MHM. 2014. ‘The management of Cash Waqf: Toward socio-economic development of muslims in Malaysia’ paper presented at the 10th International Conference on Tawhidi and The World-System: God Conscious Organization and the Conscious Management Order, Bangi Selangor Malaysia, 27 – 28 December, 2013.

Selected Publications in Books and Book Chapters:

{tab=Collaboration}

Collaboration:

Tax Research Department, Inland Revenue Board of Malaysia, Cyberjaya (2019)

{tab=Others}

Others:

Awards:

Memberships:

{/tabs}

- Hits: 6267