Master in Global Islamic Finance

Program Highlights

The Master in Global Islamic Finance is designed to produce talents who are proficient in both finance and Shari’ah knowledge with holistic approach and global insight. The program covers in depth the topics including banking, capital market, takaful, governance and contemporary issues surrounding Islamic finance. The course will give exposure to students to be innovative and creative in finding solutions of Shari’ah issues. The program also integrates the element of financial technology and business competitive intelligence in making decisions in the Islamic financial landscape.

ONE YEAR Program

Comprehensive and practical based

Global insights

Financial business intelligence perspectives

RM18,800 fee (discounted fee for Academic Session 2020/2021) for local students

USD6,000 fee (discounted fee for Academic Session 2020/2021) for international students

Why Join Us?

1. Incorporate global insights into the Islamic Finance field

2. Embed elements relevant to the contemporary issues in finance technology (Fintech)

3. Incorporate strategic tools in analysing global Islamic Finance landscape

4. Subject matter experts from both financial and Shari’ah fields

Career Opportunities

Banker, Takaful Financial Advisor, Islamic Equity Specialist, Regulation and Supervision, Research and Development, Analysis and Consultancy, Personal Finance, Wealth and Estate Planners.

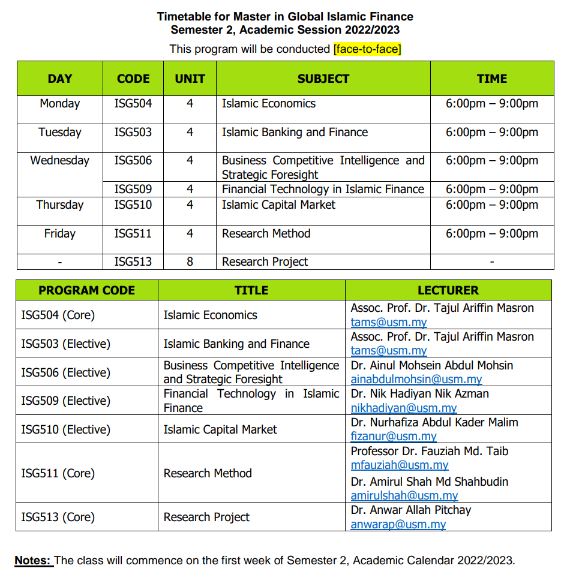

Program Structure

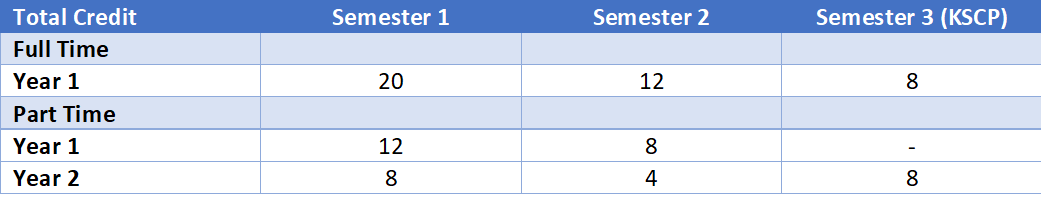

- This is a one-year program.

- Students can choose between mixed mode and coursework mode.

- For coursework mode, students are required to complete 8 courses and a research project.

By Coursework:

Courses

Core Courses (Compulsory)

ISG501/4 Global Islamic Jurisprudence

ISG502/4 Governance of Islamic Finance

ISG504/4 Islamic Economics

ISG507/4 Contemporary Issues in Islamic Finance

ISG511/4 Research Method

Elective Courses (Choose any three (3) courses)

ISG503/4 Islamic Banking and Finance

ISG505/4 Islamic Accounting and Auditing

ISG506/4 Business Competitive Intelligence and Strategic Foresight

ISG508/4 Islamic Wealth Management

ISG509/4 Financial Technology in Islamic Finance

ISG510/4 Islamic Capital Market

Project (Compulsory)

ISG513/8 Research Project

Synopsis of Courses

ISG 501/4 Global Islamic Jurisprudence

The course will discuss pertaining to sources of Islamic jurisprudence or Usul al-Fiqh which has become fundamental guideline in comprehension of Islamic law generally as well as in understanding behaviour in financial muamalat in particular. The function of the science, form and authentic of the references will be discussed particularly in the light of Islamic financial muamalat. The discourse involves the source of al-Quran, Traditions, theory of consensus, analogy, istishab, istihsan, customs, public interest, sadd al dhara'i, reasons and the practise of Companions involving contemporary illustrations.

ISG502/4 Governance of Islamic Finance

Majority of the Shari’ah governance practices are faced with challenges of shortage of knowledge within Islamic scholars and banking practitioners. Shari’ah scholars generally lack in banking knowledge while the operations people are lacking in Shari’ah understanding. The lack of established standard, the failure of management to differentiate between conventional corporate governance and Shariah governance, difficulties in understanding Shariah based laws, misinterpretation of rules and such are some of the key issues in effective implementation of Shari’ah governance in IFI’s. The apex objective of the Shari’ah governance is to ensure fairness not only to shareholders but to all stakeholders attainable through greater disclosure, transparency and accountability. Shari’ah objectives or Maqasid al-Shari’ah is the ultimate objective of Shari’ah governance which is to ensure effective independent oversight of Shariah compliance over every practice in IFIs. Credibility of IFIs in term of its accountability and trustworthiness can be built through efficient Shari’ah governance framework. Arising from the above scenario this course is to provide the students with both the knowledge and competency towards a more effective and efficient management of Shari’ah governance oversight and SNC risk in IFI’s. Furthermore, the course emphasizes on the human governance that deals with human behaviour guided by Islamic worldview in the context of Islamic financial institutions.

ISG503/4 Islamic Banking and Finance

A unique course that builds up an Islamic Monetary System from first principles as determined by Islamic Shariah, Islamic Economics and couched within the Islamic World View. The Course also outlines the ills of the current monetary system and how these would be solved by implementing the Islamic Monetary System. The Course also provides practical solutions on how to migrate from the current conventional monetary system to the Islamic monetary system.

ISG504/4 Islamic Economics

This course introduces students to the basic premise that the study of Islamic economics stems from the Islamic worldview and has to be developed according to a methodology that is founded upon this worldview. Therefore, the `foundations' that need elaboration are the Islamic worldview, Islamic economic methodology and features of an Islamic economic system.

Since economics deals with the production, consumption and distribution activities of man, and these areas will be addressed in this course. Other more prominent areas of contemporary Islamic economics such as the prohibition of riba’ and issues in Islamic banking are also discussed.

ISG505/4 Islamic Accounting and Auditing

This course aims to provide students with the knowledge of Islamic Accounting and Auditing, rationale of Islamic accounting and Islamic accounting standards. Students will be able to do accounting for Islamic financial products as well as for Zakat. Students will also be able to address current issues pertaining to Shariah governance and Shariah audit and to propose solutions.

ISG506/4 Business Competitive Intelligence and Strategic Foresight

This course will explore the ever-changing business world and how organizations make strategic decisions to be competitive through competitive intelligence. This course discusses on the process of legally and ethically gathering, interpreting, and acting on information about an organization’s competition or other forces that may affect its future success. It also touches on goal setting, value creation, global integration and diversity, in the context of the new business reality. Decisions taken by each organization is closely linked to the benefits and strategies of competitors and vice versa. It also discusses some theories and how organizations choose a strategy to achieve competitive advantage. The course also focuses on the role of the user experience, innovation and design in the form of competitive advantage. The course also includes "geopolitics analysis" to describe the performance of the business, evaluating different courses of action, foresight by using a structured approach to business problem solving.

ISG507/4 Contemporary Issues in Islamic Finance

The course aims to discuss about the philosophy and principles of Islamic finance in terms of their classification, conditions, basis and their application in the past and at present. The main focus of this course is to explore in depth the implementation of the Islamic finance and identify the contemporary Syariah issues surrounding Islamic finance. In addition, this course will give exposure to students to be innovative and creative in finding solutions of the Syariah issues that could hinder the rapid development of Islamic financial institutions.

ISG508/4 Islamic Wealth Management

The course will discuss pertaining to the management of muslims’ wealth including the field of inheritance, bequeath, endowment, trust gift, takaful, investment, asset management and tithe. The discussion will be analysed the scholars view the wealth management among Muslims and its position in the administration of Islamic law in particular agencies such as Small Estates Unit, Amanah Raya Berhad, Syariah Court and Civil High Court. The discourse will also be looking at the acts as well as enactments that having recently, including cases and fatwas that pertaining to the Islamic wealth management. This course will enhance student’s understanding on wealth accumulation, protection, distribution and purification.

ISG509/4 Financial Technology in Islamic Finance

Fintech is growing tremendously throughout the world and disrupting many areas of Finance, particularly traditional banking services. Examples include software that encourage peer-to-peer transactions that even completely bypass the banking system like cryptocurrencies, crowdfunding for project financing, working capital financing, sadaqa, wakaf etc. in a more efficient, transparent and cheap manner. Even there are applications that allow exchange of currencies that bypass money-changers and banks. Smart contracts are other interesting developments. Since many areas in banking, finance and accounting are being disrupted by Fintech, students must be kept on their toes with such new developments. Indeed, Fintech also opens a whole new area of opportunities in the area of finance, Islamic Finance in particular.

ISG510/4 Islamic Capital Market

This course is designed to provide students with the knowledge of the Islamic capital market by clarifying the concepts and products. In addition, students are exposed to appreciate the distintive characteristics of Islamic capital market as compared to conventional capital market. This course encompasses theories and practices of the Islamic capital market on a global level and highlights the key issues and challenges.

ISG511/4 Research Method

This course provides students the basic concepts and operations of research including how they form a research project and 'hands-on' skills in the use of different research methods. Students will be exposed to various research methods and will learn the basic principles of research design. Topics to be discussed in detail include sampling, measurement, interviews, analysis of case studies, focus groups, interviewing and analyzing and presenting data. Intellectual debates and methodologies will be discussed to help students develop an informed and critical opinion of other research as well as ethical research practices. Students will be equipped with the knowledge and ability to follow a good methodology, the original research project and will develop a set of research skills that can be used in the workplace.

ISG513/8 Research Project

The course will elaborate students on producing research in contemporary global Islamic finance, as well as using skills of discourse that needed in research writing based on high quality research method. In addition, the study will disseminate the method of research epistemology where references must be hold on al-Quran and Traditions guidance, as well as the thought of Muslim jurist and recent practise experiences.

Entry Requirements

- A recognised Bachelor Degree in Management, Finance, Islamic Studies or any other related and recognised degree with a minimum CGPA of 2.75; OR

- For CGPA of 2.50 - 2.74, a degree as stated above is required, with an additional minimum one year research experience/one year working experience/one academic publication in related field/Grade B for major/elective courses/Grade B+ for final year project; OR

- For CGPA of 2.00 - 2.49, a degree as stated above is required with an additional minimum five years research experience/five years working experience AND one academic publication in related field/Grade B for major/elective courses/Grade B+ for final year project; OR

- Other equivalent qualifications such as Accreditation of Prior Experiential Learning (APEL).

Apply online: http://www.admissions.usm.my

Check out the preview for this programme on our YouTube channel.

- Hits: 13815